Which is the Best Major Medical Expense Insurance 2020? This is one of the questions I get asked the most as an insurance broker. In this article, I will give you updated information to clear that question for you. These products are aimed at people that want to have the certainty that if things take a downturn with their health, they have guaranteed the resources to have the best medical services in Mexico and all over the world.

The major medical expense insurance I will analyze are:

- Best Doctors Insurance

- BUPA Mexico

- GBG AXA

- Panamerican

The features

Here are some of the features that distinguish these four insurance companies from other available in the market:

- These insurances operate with an annual deductible. So, once this has been covered, the expenses for any illness are already included.

- The insurance covers the medical expenses anywhere in the world.

- The insurance company will pay for the medical fees of the doctor of your choosing. Which means you don’t have to pick a doctor within the network of providers in agreement with the insurance company.

- You have complete coverage from the moment of your hire the policy.

- The insurance company covers 100% of the expenses of the medical attention necessary, due to the fact there coinsurance are inexistent here.

Now, let’s review each one of these Insurance Companies so we can answer the question; which is the best Major Medical Expense Insurance 2020? If you want to know a bit about the origin of international insurance, our article The History of the Danish Insurance might interest you. I am positive that having that information will be a great leverage, so you benefit from this information.

In search of the best

I will start by analyzing the four companies in the three dimensions that I believe are truly important for the medically insured:

- Life coverage

- Coverage scope

- Portability

The best insurance companies

| Insurance company | Coverage | Scope | Portability |

|---|---|---|---|

| Best Doctors | 10 | 10 | 10 |

| Bupa | 8 | 9 | 8 |

| GBG-Axa | 8 | 10 | 8 |

| Panamerican | 10 | 9 | 10 |

Best Doctors Insurance

This company is owned by Now Health, a British consortium based in Hong Kong which offers international health insurance to more than 100,000 people all over the world. Best Doctors caters to their Mexican clients at their Miami, Florida branch.

Even if Best Doctors does not have offices in Mexico, it is highly recognized at the main hospitals in the country, such as, Angeles Group, ABC Hospitals, Star Medica, Amerimed, Zambrano Hellion, San Javier, etc.

The company has also received various international prizes for their Interconsultation services, a procedure that allows for patients to be diagnosed and receive treatment confirmation by the best doctors in the world, without needing to travel abroad to receive it.

Life coverage

Score: Excellent

The clauses of the contract establish that the renewal of the policy is for life and automatic. No other conditions or exceptions are added to this disposition. Therefore, the insured and their families are free to change their occupation, habits or hobbies during the time of their insurance.

Why is this important? Because the insurance holder can make changes in their way of life without affecting their insurance. What is much more important, is that their children, grandchildren or their minor dependents can choose the profession and hobbies they please when they become adults.

Best Doctors grants the couples or domestic partners (how they name the couples of the insurance holders) the right to ask for an independent policy in an automatic way and with the recognition of the effects of any illness, or accident that happened in the duration of the first policy. This is very important because it guarantees that in case of the divorce or separation of the family policy holders, everybody has a right to keep their insurance.

Coverage scope

Score: Excellent

Policy year insured sum

In all cases, the insured sum is reinstalled every year, even for the same ailment and there is no limit per event.

Portability

Score: Excellent

This is an insurance that is completely global. Leaving out Cuba, North Korea, Syria, Libya and Iran, the insurance holder can move anywhere in the world and keep their medical insurance.

You may also be interested in: Let’s Rate Best Doctors International Health Insurance

BUPA Mexico

Globally, Bupa is the giant of medical insurance. They cater to over 30 million people. The British United Provident Association (Bupa) was created in the United Kingdom in 1974. They were authorized to operate in Mexico in 2003. Despite the fact that the whole of its operations is mainly operated in Miami, Bupa Mexico, Compañía de Seguros, SA de CV, is registered in Mexico as a company, legally independent from the main company.

Coverage scope

Score: very good

Besides the yearly coverage limit, the contracts of this insurance have a cap limit for event of 100 million pesos. In other words, there are two limits, the limit of the yearly insured sum and the maximum per event. The obligation to establish insured sums with a cap was established in 2013 by the Comisión Nacional de Seguros y Fianzas, which is the organism in charge of regulating the Mexican Insurance Market, which is also why we find the capped amounts in Bupa’s, GBG’s, AXA’s and Panamerican products.

In this dimension Bupa Mexico offers the lowest insured amount for event, among these three companies.

Look at this example to have a better understanding of this:

A client covered by the Global Select insurance could spend up to 2 million dollars a year and remain without coverage until the date of the following policy anniversary. The following year, she will have another to 2 million dollars. If in the whole medical history of the policy holder they spend more than 100 million pesos while attending to the same diagnosis, that person will no longer be covered for said ailment. Putting this in context, the amount currently offered by Axa, GNP, MetLife, Seguros Monterrey and the rest of the insurance companies that operate in Mexico is about 100 million de pesos.

So, why is this special then? The problem of hiring ensured amounts in Mexican Pesos is that should the peso devaluate abruptly, the coverage of the insurance shrinks at the same rate as the peso loses value. Just imagine that a devaluation in which the peso should get to 50 pesos per US dollar. If unfortunately, this economic cataclysm is combined with a severe illness you will end up without an insurance in a couple of years.

Life coverage

Score: Regular

In the search of the best medical expenses insurance, this company rates the lowest amongst its competitors, due to the fact that the contract preserves the aggravation of risk figure as established in the Law over the Insurance Contract. This allows for them not to cover their obligations if there is a change in the life conditions of the insured, that if the company had knowledge of when hiring the policy, it would have resulted in a different risk assessment.

Allow for me to stop a bit to explain this concept – as I’ve already said, as stated by law -. It was created to protect the insurance companies from abuses from the insured on damage insurance. For example, the owner of a boiler that leaves it operating at a pressure above factory standard to achieve a better performance. Which evidently increases the risk of an explosion.

This law concept is incorporated in most medical insurance contracts in Mexico. However, it is evident that people are not like bon manual nor do we always do the same things at the same intensity. This disposition tilts the balance against the end user of the major medical expense insurance. You should also consider that which is established on clause 6. Contract renewal, which establishes that:

“In case the policy holder changes address or occupation, the policy renewal will be subject to Bupa’s approval.”

I will talk about change of residence more in depth later. I consider that this point is an important flaw on the contract that this insurance company offers. The selection of the best medical expenses insurance must be a long-term decision. And it is evident that it is very hard to plan long-term if there are restrictions such as not changing jobs. It is impossible to have certainty in knowing what we will be doing in 10 or 15 years.

Portability

Score: Regular

At first sight, they are the international insurance portability champions because of their having presence in almost any country in the world. However, we need to observe two important facts. Bupa preserves the right to continue the coverage if the insured stops living permanently in Mexico and in case that the insured moves to the United States, the coverage is ceases to exist.

You may also be interested in: Let’s analyze Bupa’s international health insurance

GBG AXA

In November 2018, Axa Mexico launched, in Alliance with the American insurance company Global Benefits Group (GBG), to the market a new international medical expenses insurance. GBG is one of the largest insurance companies in the world, within the international life, health and travel insurance. The agreement between Axa Mexico and GBG creates an innovative offer within the Mexican International Insurance Market. The service claims payment and policy management are performed by GBG.

The insured have their contracts signed with Axa Mexico, which gives him the benefits (and some limitations) of working with a local insurance company.

Coverage scope

Score: Excellent

The contracts of these insurances mark an insured sum by event of 10 million dollars.

This limit offers two clear advantages over Bupa’s offer:

- It’s practically the double.

- It is denominated in US dollars, so a devaluation of the Mexican peso will not affect its value.

Life coverage

Score: Regular

GBG’s offer for Mexico establishes the obligation by contract for the insurance company to guarantee the life renewal of the insurance. In contrast to Bupa’s offer, the life renewal is not conditioned for the holder not to change occupation or profession. Even if in the contract keeps the figure of “risk aggravation”, which we have covered extensively in this article dedicated to Bupa.

Portability

Score: Regular

International portability is perhaps the most restrictive part of medical expenses insurance hired by Mexican insurance companies. Just like Bupa, and what we’ll see about Panamerican, the GBG-Axa policy establishes that the coverage is offered solely to permanent residents of Mexico.

You may also be interested in: Let’s rate Axa GBG international medical insurance

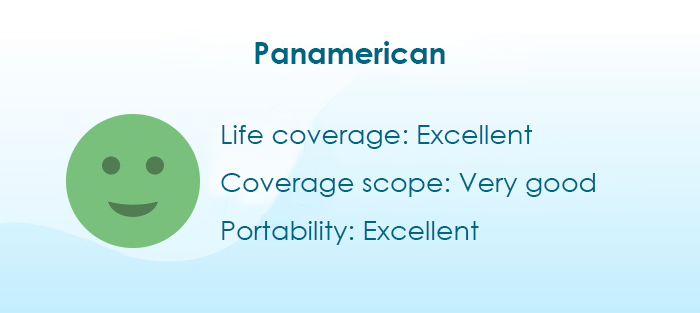

Panamerican

Panamerican Life Insurance Group (PALIG) is an American company established in 1911 in New Orleans. It has presence in 49 states of the United States and to the authorization of the Mexican a large part of Latin America. In 2012, they followed Bupa’s steps and got authorized by the Mexican authorities to establish Pan-American México, Compañía de Seguros, SA de CV.

It might be interesting for you know that this is the second time that PALIG gets established in Mexico. In the 1960’s they were a minority partner of an insurance company (at that time, foreigners could not own an insurance company in Mexico), and they had an important presence in the life insurance market. In 1979 they abandoned the market. Even if officially this was an issue of a difference in strategies with their partners, rumor has it that there was fraudulent mismanagement from the local managers.

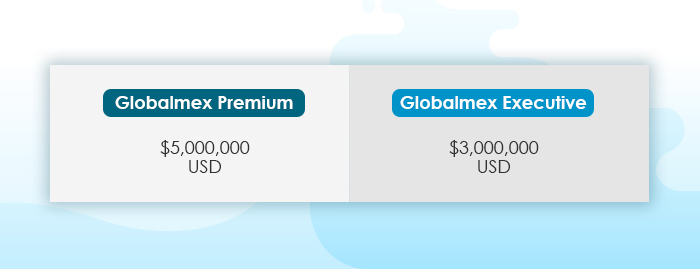

Scope coverage

Score: Very good

- World Access con with an insured sum of 5 million dollars.

- Acceso Mundial (there is an option in pesos of an insured sum of 100)

- Preferred Access offers 2 million dollars of insured sum.

- Acceso Preferencial which is the version in pesos of the Preferred Access product. It has an insured sum of 40 million pesos.

Just like in the cases of Bupa and GBG-Axa, Panamerican’s contracts have two insured sums. The yearly one and the insured maximum sum per event. The policies of World Access and Preferred Access have insured sums per event of a maximum of US$8,000,000. While their counterpart in Mexican pesos Acceso Mundial y Acceso Preferente, have a coverage limit per event of $160 million pesos.

Life coverage

Score: Excellent

This contract obliges the company to the renewal of the insurance for life in conditions that cannot be less favorable to the insured than the originally agreed upon. The causes to terminate this contract are also established and are basically the lack of payment of the premium or the fact that the insurance holder is caught in deceiving or fraud attempt against the insurance company.

Likewise, the contract establishes that Panamerican Mexico renounces to the right that the Law of the Insurance Contract gives them to deny making a payment in an event in which the insured has incurred in what is known as an essential aggravation of risk. This is of utmost importance because it guarantees that once the insured has been accepted by the company, they can change occupation, habits or hobbies with the certainty that this will not have an impact n their insurance coverage.

Portability

Score: Excellent

They also offer the possibility for the insured to continue with their insurance even in case of a change in their country of residence. However, there are two important things to consider. First: there is no option to reside permanently in the United States. Second, because this is a company concentrated in Latin America, if the move were from one country to another, outside of this area, the insured could face service difficulties.

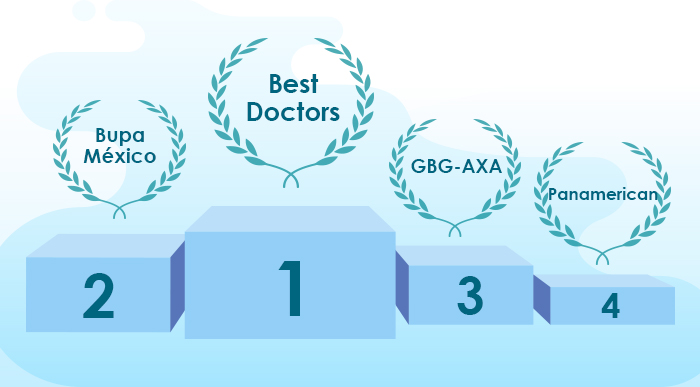

Which is the best Major Medical Expense Insurance?

Answering this question is like choosing on the best automobile brand between Bentley, Mercedes Benz, Porsche and Rolls Royce. The sole facto f being able to choose a vehicle from any of these brands is already a privilege. However, the title of the article promises an answer. So, the best medical expenses insurance in Mexico is:

1. Best Doctors Insurance

This Brand offers the simpler contract and the clearer guarantee that this is an insurance you will be able to keep for life, regardless of the changes you might be facing in the future.

2. BUPA México

Bupa has the largest infrastructure for the medical expense insurance services in the world. They also offer a vast array of benefits in preventive medicine that turn this into a policy you can use. I chose not to assign BUPA the first place because their contracts do not guarantee any life coverage if there are any important changes in the life of the insured.

3. GBG-AXA

The alliance between GBG and Axa is a very promising one. They offer an international medical expense insurance with the financial back-up of one of the largest Mexican insurance companies. The maximum insured sum per event of 10 million United States dollars is the best one offered by a Mexican insurance company with the VIP product of GNP (I am not analyzing that here, for it is not an international medical insurance, but a Mexican insurance policy with coverage abroad).

A very Good alternative for those who decide to hire a local insurance company, but that want to have the advantages of international insurance companies.

I assigned this one the third place, because its introduction to the Mexican market has less than a year, and we are not certain if they can keep to the level of service that is expected from this kind of insurance or if they are willing to invest what is necessary to keep their prices competitive.

4. Panamerican Mexico

Panamerican offers an excellent contract. In fact, I dare to say, the best of any Mexican insurance company. However, I have lived along with my clients, some bad service experiences. We also have to consider that in the past two years, they price increase has been way above that of its competitors. It is likely they had been very optimistic calculating the costs of medical attention in the Mexican market and are now having to make the necessary adjustments to continue being profitable.

Each one of the policies we analyzed has its advantages and its strengths. And it might require an exhausting effort for you to find the one that is most convenient for you. Which is why, I dove deep in the contracts to shed some light in your decision while choosing the best medical expenses insurance policy. I hope you find it helpful.

In summary

Each insurance has its advantages and weak points, but, it can take a very tiring effort to find the one that works best for you. So, I delved into contracts in order to answer the question, Which is the best major medical expense insurance? and help you make the decision. I hope you find it useful.

You may also be interested: The Complete Guide to 2020 Major Medical Expense Insurance

Referencias